Understanding the Importance of Backtesting Expert Advisors ===

Backtesting is an essential process in the world of forex trading. Expert Advisors (EA) are automated trading systems that traders use to execute trades. These EAs are programmed to follow specific strategies and make decisions based on pre-determined parameters. Before deploying these EAs in live trading, it is crucial to test their effectiveness and profitability. This is where backtesting expert advisors come into play. By simulating historical market conditions, traders can evaluate the performance of their EAs and make informed decisions about their strategies.

=== Step-by-Step Guide to Conducting Effective Backtests for Expert Advisors ===

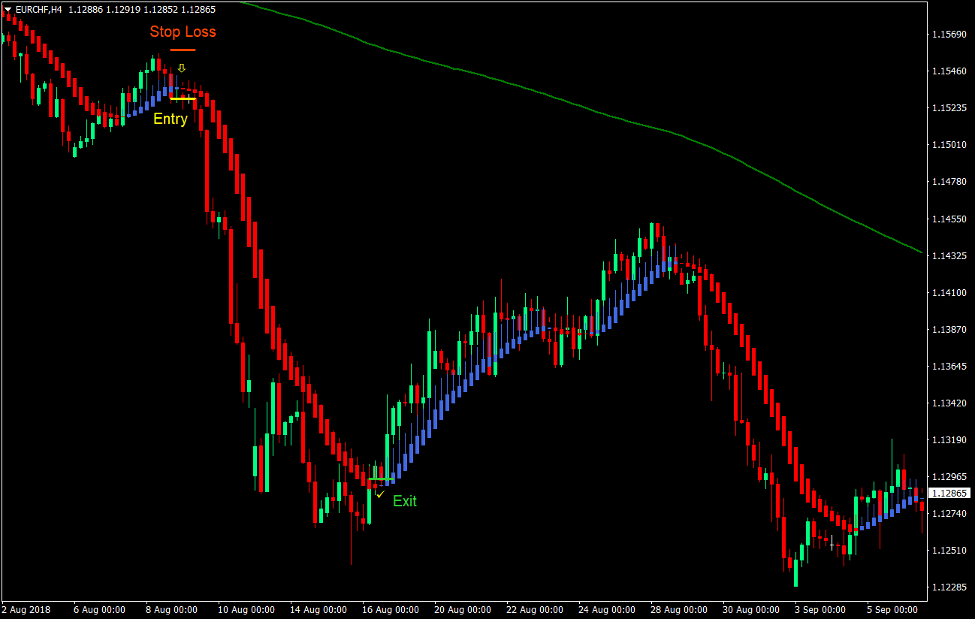

- Define your trading strategy: Before beginning the backtesting process, it is important to clearly define your trading strategy. This includes determining the entry and exit rules, stop-loss and take-profit levels, and any other relevant parameters. Having a well-defined strategy is crucial for accurate backtesting and reliable results.

- Gather historical data: The next step is to gather historical data for the currency pair or instrument you intend to trade. This data should cover a significant period, ideally several years, to ensure a comprehensive evaluation of your EA’s performance. Reliable sources such as reputable forex brokers or data providers can be used to obtain this data.

- Choose a backtesting platform: There are various software platforms available that facilitate backtesting of expert advisors. MetaTrader, one of the most popular trading platforms, offers a built-in strategy tester that allows traders to backtest their EAs using historical data. Other platforms like TradingView and NinjaTrader also provide backtesting capabilities. Choose a platform that suits your needs and is compatible with your EA.

- Set up the backtesting parameters: Once you have selected a backtesting platform, configure the parameters for your backtest. This includes selecting the time period, defining the initial account balance, and specifying any other relevant settings. It is important to replicate real-world trading conditions as closely as possible to obtain accurate results.

- Run the backtest: With all the necessary parameters set, run the backtest on your chosen platform. The software will simulate trades based on your EA’s strategy using the historical data you provided. Pay close attention to the performance metrics generated during the backtest, such as profit/loss, drawdown, and win rate.

- Analyze the results: After the backtest is complete, analyze the results to gain insights into the performance of your EA. Look for patterns, trends, and any areas that need improvement. Consider the risk-reward ratio, consistency, and overall profitability. It is essential to assess whether the EA aligns with your trading goals and risk tolerance.

- Optimize and refine: Based on the analysis of the backtest results, make necessary adjustments and optimizations to your EA. This may include tweaking parameters, modifying the trading strategy, or implementing additional risk management measures. Repeat the backtesting process to validate the effectiveness of these changes.

===

Backtesting expert advisors is a vital step in the development and deployment of automated trading systems. By conducting thorough backtests, traders can assess the performance and profitability of their EAs before risking real capital. Following a step-by-step guide, traders can ensure effective backtesting, leading to improved trading strategies and informed decision-making. Remember, backtesting is not a guarantee of future success, but it provides valuable insights that can help traders refine their EAs and increase their chances of achieving consistent profitability in the forex market.